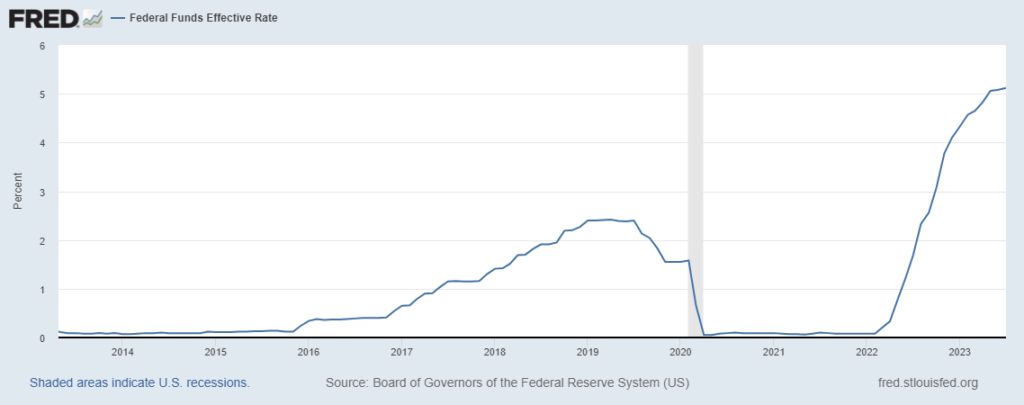

Interest rates play a pivotal role in shaping the global economy. The recent uptick in these rates (e.g. the FED Fund rate, see below) has sent ripples through financial sectors worldwide: very concretely, access to property ownership has hardened considerably throughout the world. However, real estate is not the only sector affected; finance professionals continue to assess the implications of our new economic environment.

One sector not immune to this shift is private equity. Born in the 1980s, private equity, especially in the guise of leveraged buyouts, operates in an intricate dance of financial engineering. For a journey through time, I refer you to the book ‘Barbarians at the Gate‘. The modus operandi is fascinating: a fund acquires a company primarily using borrowed capital, hence acquiring targets much larger than the ones it would be able to acquire without any ‘leverage’. The subsequent cash flows generated by the purchased company are then channelled to settle this looming debt, magnifying ultimate returns for shareholders.

At the heart of this financial ballet is a delicate equilibrium. The goal? To strike an optimal balance of leveraging just the right amount of debt to optimize shareholder returns, all while ensuring the company remains solvent and can comfortably meet its debt obligations. The game was facilitated by the declining trend in interest rates, which allowed funds to impose an increasing amount of debt on their targets, and quite rosy earnings growth expectations. Unfortunately for the fund managers, this paradigm has been violently shaken in recent months, as depicted in the Financial Times last week.

For many years, this model indeed found its rhythm and thrived, particularly in times of diminished interest rates or when earnings growth was robust. Imagine a climate where low interest rates emboldened companies to take on large debts, amplifying the rewards for shareholders. This phenomenon mirrored the real estate sector. As interest rates dipped, credit became more accessible, and property valuations soared. As a result, lending institutions provided loans with increasingly favourable terms, sometimes even exceeding 120% of a property’s net asset value. Their gamble? Even if homeowners defaulted, rising property values would have risen in the meantime, ensuring recovery of the principal amount through a sale in any case.

The Winds of Change

However, today’s financial atmosphere is evolving rapidly. As we witness a contraction in growth and a significant surge in interest rates the private equity sector grapples with new hurdles. Alarmingly, many funds, banking on the permanence of low interest rates, ventured into acquisitions without adequate interest rate hedges (or protections). This is somewhat akin to homeowners opting for floating-rate mortgages, buoyed by the belief that these favourable rates would persist for the typical 5 to 7-year investment horizon. One only needs to see the despair of some British mortgage owners to realize the effects of such a large-scale investment policy.

This has set the stage for potential turmoil, with several firms caught in a precarious position, struggling to manage their significant debt load. Such scenarios evoke memories of the subprime mortgage crisis, presenting companies with a binary choice: either renegotiate the debt or capitulate and hand over the reins to debt holders.

Yet, reality often presents more nuance than this binary suggests. The realm of managing — and importantly, revamping — companies isn’t the traditional domain of debt funds. Furthermore, debt packages came historically embedded with ‘covenants‘— protective clauses allowing creditors to seize control if they perceived threats to a company’s financial health, even if the firm was still technically solvent. However, a surge in cheap capital availability since the last financial crisis has progressively led to the relaxation of such safeguards. Compounding this, private equity funds, always wary of public perception, are reticent to broadcast any loss of control over a portfolio company. This confluence of factors suggests that the most pragmatic approach, borrowing insights from game theory, is to uphold the existing shareholding structure while orchestrating a strategic debt restructuring.

Future Prospects: Challenges and Opportunities

On its face, preserving a beleaguered company might seem a noble endeavor — protecting jobs and ensuring economic stability. However, when viewed through the lens of capitalist principles, the narrative shifts. Efficient capital allocation is paramount. Echoing Schumpeter‘s sentiments, periodic disruptions or “creative destruction” are essential to redirect capital toward groundbreaking and efficient avenues. Although debt restructuring offers a potential lifeline, it might inadvertently keep ‘zombie companies‘ afloat — entities that, despite being operational, fail to truly compete or innovate.

Stakeholders in creditors’ funds span a broad spectrum, from pension funds to individual investors. Adverse outcomes from debt restructuring, while conceptually distant, can have tangible ramifications, potentially jeopardizing the financial well-being of retirees and everyday investors who, through their own (pension) funds, are ultimately large investors in debt funds.

In Conclusion: time for a reset?

The 15-year era characterized by historically low interest rates was a unique financial phenomenon. While this environment facilitated unparalleled innovation by providing easy capital access, it simultaneously inflated asset valuations and propped up firms that, by traditional economic standards, might not have been viable. This phase has concluded, and it is unlikely we will revisit such conditions in the foreseeable future. Consequently, we are transitioning into a phase of financial recalibration, where the primary task for policymakers, investors and executives will be discerning sustainable value from mere speculation. It is imperative that this distinction be made to steer our economy back towards a robust growth trajectory. As we navigate this transformative phase, be prepared with new skills: not every player will make the cut, and the landscape of winners and losers is set to shift dramatically.