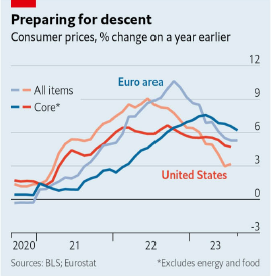

For several months now, it has been hard to open a serious newspaper, whether economic or not, without finding at least one article on inflation. The reasons are understandable: after about fifteen years at a near-zero level, inflation suddenly awakened following the COVID-19 pandemic, reaching levels not seen for nearly 40 years.

Today, while the situation seems to be gradually calming down, the rise in prices, due to its considerable impact on household purchasing power, and ultimately on the health of our economies, the cohesion of our societies, and the well-being of each of us, continues to worry businesses and governments, for whom inflation remains “too high.” This brings me to the subject of this week’s article, in the form of a question: what is the “right” level of inflation?

Let’s proceed by elimination by excluding some undesirable scenarios. It seems quite obvious that a situation of hyperinflation, as countries like Argentina or Turkey are experiencing today, cannot be considered satisfactory. If prices double from one year to the next, it encourages you to make as many purchases as possible as quickly as possible, thus increasing demand and further fueling inflation (since prices aim to reconcile supply and demand), and/or to put your savings in another currency, generally the US dollar, which also fuels inflation (via a depreciation of the local currency). To resist, you also have to think about renegotiating your salary with your boss almost every week, which is not very practical.

The opposite situation, called deflation (decrease in prices), as currently experienced in China, might seem more pleasant at first glance. Prices decrease, so “without doing anything,” your purchasing power increases. Unfortunately, another vicious cycle sets in here: if you know that prices will decrease, you postpone as many purchases as possible, decreasing demand, thus prices, and companies’ margins (since salaries cannot be adjusted downward), which must then adapt by reducing their activity and ultimately laying off workers. Layoffs weigh on purchasing power and further depress demand, triggering the spiral. The “without doing anything” is therefore illusory: deflation can lead to recession.

Between these two extremes, the task of policymakers is to determine what is the ‘right’ level of inflation. “Zero inflation,” namely price stability, as we have known it for the last fifteen years, seems to be a good candidate. As an employee, there’s no need to constantly negotiate wage increases; as a company, the comfort of a purchasing and selling price policy stable over time; as a government, stability in tax revenues and expenses.

In this situation, it may be useful to imagine inflation as the flow of a river. If the flow is too high, the river overflows, swimmers drown… On the other hand, if the flow is non-existent, the water stagnates and harmful bacteria develop. A renewal of the water is therefore necessary to ensure good hygiene.

The economic fabric also has its hygiene and must sometimes be cleaned. Last week, I wrote about interest rates, the increase of which will harm a large number of companies but will allow the most robust to stand out. Here, if we reason a bit coldly, the viewpoint is similar: inflation allows you to identify the “economic agents” (companies, employees, etc.) who have real value in their current role and therefore can exercise their “pricing power” (a principle dear to Warren Buffet):

- For a company, is my offer of products and services attractive enough to continue to attract customers, even if I have to raise my prices? If not, how should I reposition it?

- For an employee, is my contribution to the company significant enough to justify a wage increase? If not, should I change companies, train myself, and/or consider a career change?

In the absence of inflation, the importance of these kinds of considerations is greatly diminished and risks allowing “zombie companies” that create little value and therefore few interesting opportunities for individuals to survive. For this reason, it is defensible to want to maintain a slightly positive inflation rate to ensure the renewal and dynamism of the economic fabric (in developed economies, central banks have traditionally set this target at 2% per year, without any text enshrining it in law).

Determining that low inflation is desirable unfortunately does not explain how to fight too high inflation. State control of prices, a mechanism brought back into fashion in some articles, is not suitable: if “market” prices are blocked and no longer cover producers’ costs, these same producers will go bankrupt or, more likely, prefer to sell their production through other, more profitable channels, such as the black market, creating a shortage in any case on the “official” market. As for imposing both selling prices and production quantities, one only has to see the success met by planning in the former USSR…

It is therefore only by adjusting supply and demand that prices can find a reasonable trajectory. However, as I wrote two weeks ago, the time of “everything, everywhere, all the time,” a historical anomaly, is certainly over: our consumption habits, without falling into decline, must change to adapt to this new global situation.